GCash, the leading mobile wallet in the Philippines, announced several new features and services at its annual FutureCast event in 2024. These innovations aim to enhance user experience, security, and financial accessibility.

Enhanced Security Measures

GCash introduced Online PaySafe, allowing users to complete transactions within the app securely. The new Send Money Protection offers coverage up to PHP 15,000 for a fee of PHP 30, valid for 30 days. Gigi, an AI-powered assistant, can help users with various tasks, including securing accounts in case of phone theft.

Improved User Interface

A redesigned dashboard features new tabs for easier navigation. The app now includes new virtual assistants: GCat for general use, Corey G for loans, and Graf for investment guidance. A money manager tool helps users track their spending habits.

Personalized Services

GScore, calculated based on spending, saving, and money management habits, provides access to priority services and special perks. Users will receive personalized ads based on their usage patterns. GCoach AI offers tailored financial advice.

Environmental Initiatives

The app now tracks how digital transactions reduce users’ carbon footprints. Users can plant trees through the app, with 2.8 million trees (11.6k hectares) planted so far. GImpact encourages users to create a greener future with every transaction.

GCash for Minors

GCash Jr. and GSave Jr. allow parents to create accounts for their children with set limits. Children can receive their allowances, purchase load, and make online payments or via QR. They can even have their own GCash Jr. Visa Card. Parents can set up accounts using their child’s valid ID, including school IDs.

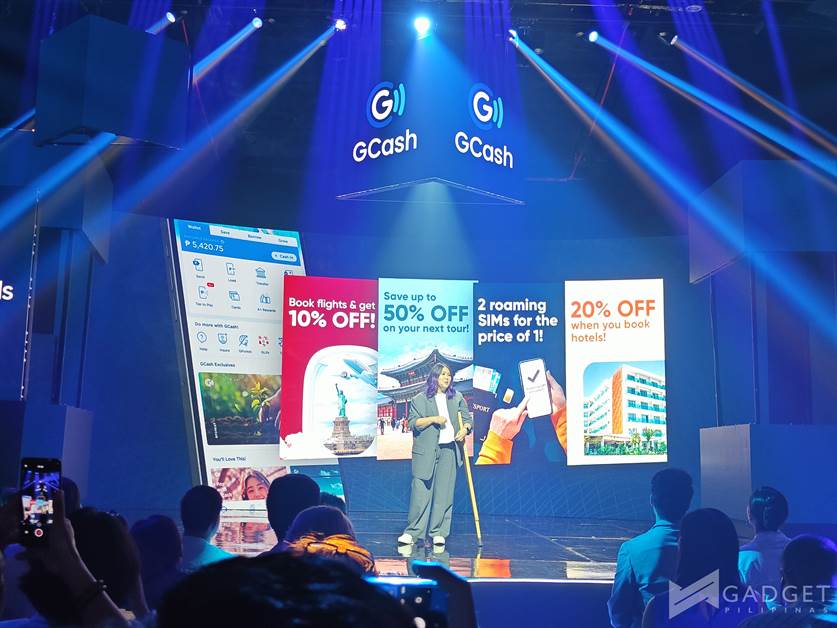

Services for OFWs and Travelers

Overseas Filipino Workers can now cash in to GCash from international bank accounts for a flat fee of 1 USD per transaction. GTravel offers travel insurance with coverage up to PHP 2.5 million. Users can claim tax refunds via GCash and book flights and hotels within the app. Tourists can access GCash features for 30 days upon arrival in the Philippines.

Tap to Pay, Watch Pay

GCash now offers on-the-spot borrowing for urgent expenses. Commuters will soon be able to use Tap to Pay via NFC on specialized terminals for public transportation with no need to submit requirements or application forms, and no fees. GCash has partnered with Huawei for Watch Pay, enabling payments via wearable devices.

We’ll have more updates as some of these features become available, so stay tuned. For more information, visit the brand’s official website.

Source: Gadget Pilipinas

0 Comments